unlevered free cash flow yield

Cash flow available for debt service CFADS is arguably the most important metric in project finance. 427 Normalized Earnings.

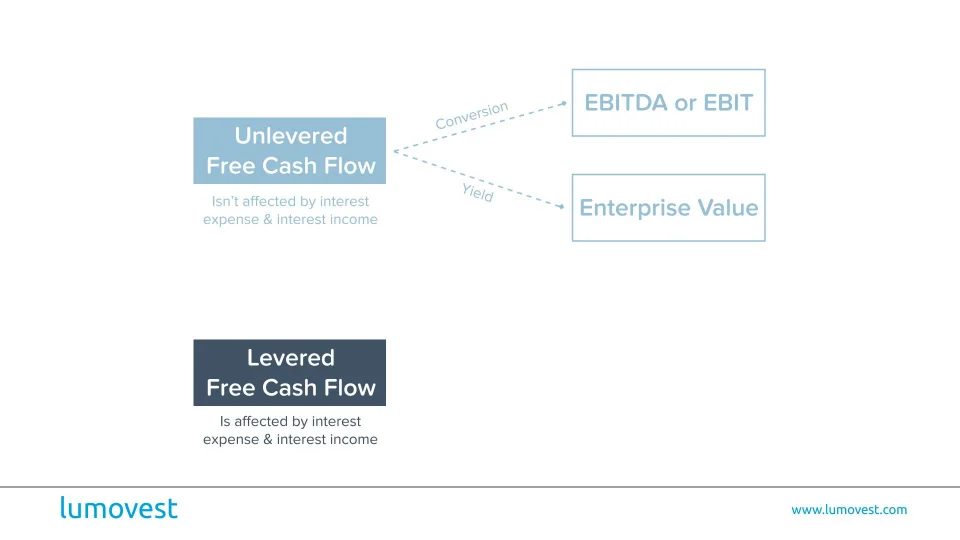

Consistency Of Free Cash Flow Ratios Lumovest

This measure serves as a proxy.

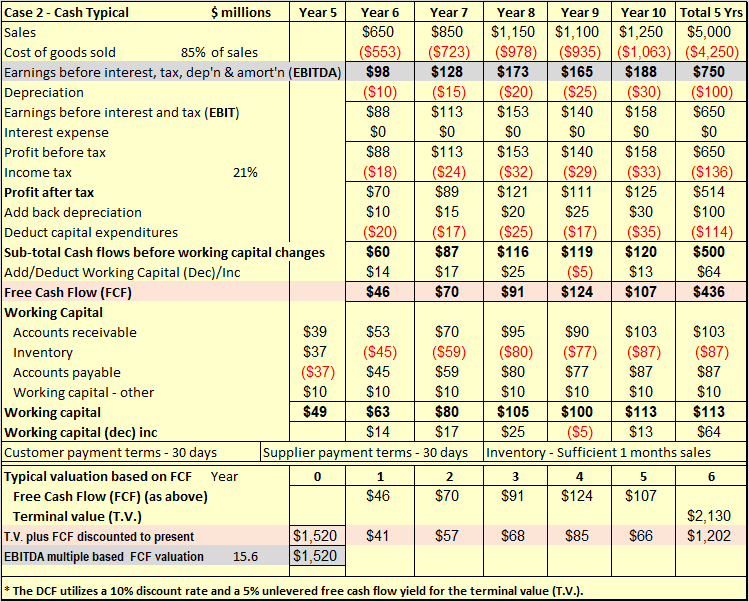

. Implied ERP in previous month 569 Trailing 12 month with adjusted payout. Implied ERP annual from 1960 to. Free Cash Flow Yield.

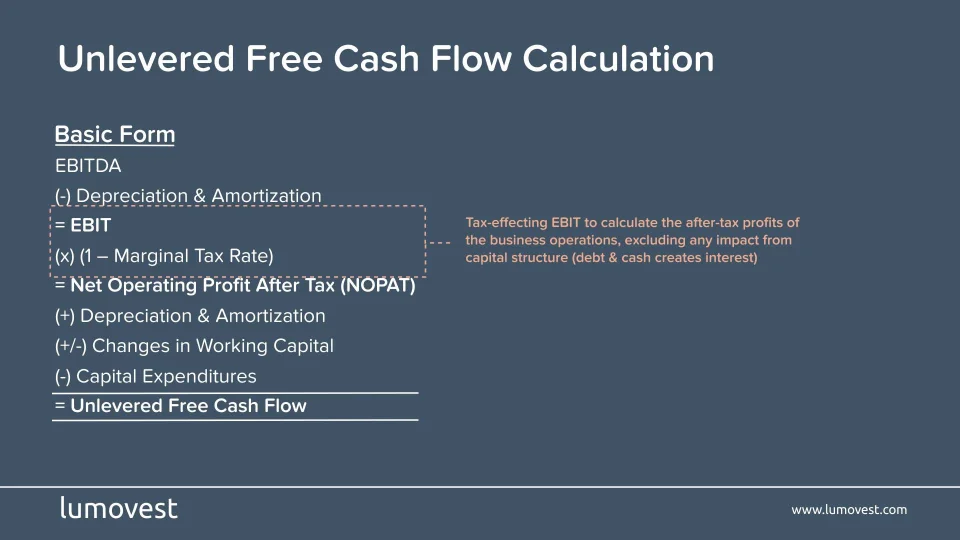

Examples of Cash Conversion Cycle Formula With Excel Template Lets take an example to understand the calculation of Cash Conversion Cycle in a. Discount both the free cash flow projections and terminal value by an appropriate cost of capital weighted average cost of capital for unlevered DCF and cost of equity for levered DCF. 601 Trailing 12 month cash yield.

566 Net cash yield. Saat membangun financial model arus kas disebut sebagai unlevered free cash flow alias arus kas bebas tanpa beban arus kas sebelum dikurangi biaya-biaya. The cash on cash return formula is simple.

Stands for days inventory outstanding DSO. How the DCF Works Overview Based off any available financial data both historical and projected the DCF First projects the Companys expected cash flow each year for a finite number of years Second sums all the projected cash flows from the first step And lastly discounts the result from the second step by some rate to yield the value in terms of present. Stands for days sales outstanding DPO.

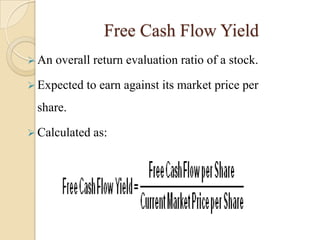

Dalam penilaian obligasi pembayaran bunga dan pokok akan disebut sebagai cash flow. FCF yield is also known as Free Cash Flow per Share. Cash on cash return is a metric used by real estate investors to assess potential investment opportunities.

Next figure out the number of years until the future cash flow starts and it is denoted by t. Cash on cash return is a levered ie after-debt metric whereas the free and clear return is its unlevered equivalent. It determines how much cash is available to all debt and equity investors.

It is sometimes referred to as the cash yield on an investment. Unlevered free cash flow can be reported in a companys. Free cash flow per share is a measure of a companys financial flexibility that is determined by dividing free cash flow by the total number of shares outstanding.

Unlevered Free Cash Flow - UFCF. Finally the formula for present value can be derived by discounting the future cash step 1 flow by using a discount rate step 2 and a number of years step 3 as shown below. 590 Average CF yield last 10 years.

In an unlevered DCF the more common approach this will yield the companys enterprise value aka firm and transaction value from which we need to. Stands for days payable outstanding. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

Free cash flow yield is a ratio wherein a FCF metric is the numerator and the total number of shares outstanding is the denominator. A company with debt will have a higher unlevered FCF yield than a levered FCF yield. Conceptually similar to unlevered free cash flows CFADS is calculated as follows.

Rate dapat mengacu pada discount rate atau tingkat diskonto ini biasanya mengacu pada WACC.

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Explained

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Free Cash Flow Ufcf Lumovest

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Definition Examples Formula

What Is Free Cash Flow Calculation Formula Example

Free Cash Flows Let S Have A Discussion Towards A Better Understanding Seeking Alpha

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial